Article

Community Banks Gain Market Share in Credit Card Issuing

The latest survey by Elan Credit Card and PYMNTS Intelligence reveals that credit unions and community banks have substantially increased their footprints in the consumer credit card space in recent years.

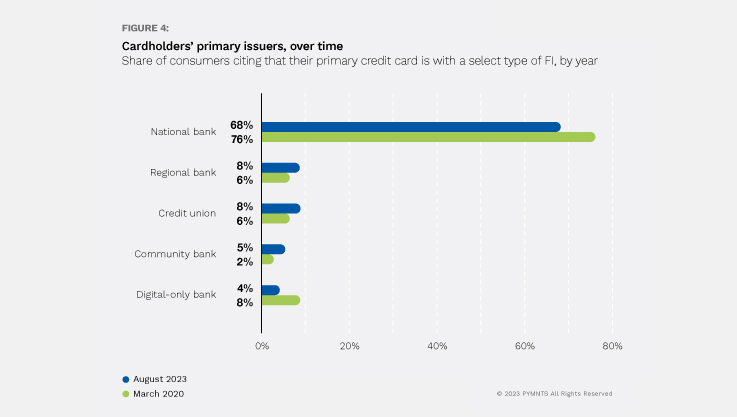

Credit unions increased their share of primary credit cards from 6% in 2020 to 8.3% in 2023. Local banks more than doubled their shares, moving from 2.3% to 5.1% in the same period. Though modest in absolute terms, these shifts represent sizable relative gains.

While national banks issue 68% of primary consumer credit cards, 24% of consumers surveyed said they would likely choose a credit union or community bank for their next credit card.

The research also shows that smaller financial institutions can maximize their competitiveness by providing key features that cardholders value, including rewards programs and the ability to split payments.

National banks remain the goliaths of the consumer credit card industry, and their dominance will not be challenged anytime soon. Nevertheless, credit unions and community banks have significantly increased the shares of consumers choosing them for their primary credit cards in recent years. This trend is poised to grow as many consumers prefer credit unions and community banks for their next credit card, including sizable shares of those currently without a primary card.

Learn more in the full report here.

Tags:

ARTICLE

Why Financial Institutions Should Act Now on Virtual Cards

Whether through integration with digital wallets, enhanced fraud protection, or real-time issuance, virtual cards offer a compelling value proposition across generations and tech segments.

ARTICLE

Driving Partner Growth with Technology

Elan partners benefit from the scale and ease-to-market ability of our ongoing investment in technology — at no cost. Here are a few of our recent enhancements.

Start a conversation

If you are interested in learning how Elan can help build your credit card program, we'd love to hear from you.